[Warsaw, Poland] September 14th, 2023 – Nethone, the Know Your Users AI-powered fraud prevention company, has partnered with Verifi, A Visa Solution, to enable merchants that meet Visa Compelling Evidence 3.0 criteria to deflect first-party misuse disputes.

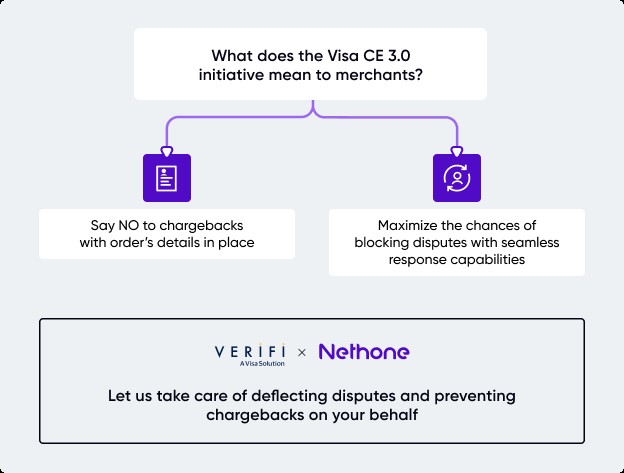

With increased rates of friendly fraud and chargebacks, followed by time-consuming dispute-related processes, merchants require a more transparent relationship with consumers and an efficient way to respond to disputes that don’t touch their revenue.

Nethone has partnered with Verifi to deliver a solution with significant benefits to merchants that meet the Visa CE3.0 requirements. Over the last 10 years, Visa has continued to build strong data infrastructure to ensure safer, smarter solutions for merchants both before the transaction to prevent fraud and in the post purchase environment for next generation dispute management. Merchants can effectively prevent illegitimate payment disputes, so their fraud and dispute ratios remain unaffected. In addition, by eliminating billing confusion on the consumer’s end, transparency is strengthened, fostering a positive merchant-consumer relationship.

Deflecting disputes under Visa CE3.0 criteria involves a multi-step process that requires transaction-related data sharing between the issuer, merchant, chargeback management provider, and Visa. Nethone’s profiling solution captures crucial data attributes to ensure the requirements are in line with Visa CE3.0 rules. The company also handles the entire process on the merchants’ behalf, facilitating the journey towards dispute deflection.

Patrick Drexler, VP of DACH and Friendly Fraud comments: “There is a better option than challenging friendly fraud disputes, and that is preventing them from happening in the first place. We enable merchants to provide stronger evidence that shows they are not responsible for illegitimate chargebacks, and this is possible with our profiling solution and advanced automated tools”.

Nethone has already been addressing the chargeback and friendly fraud issues with their Nethone Alerts, a solution that sends notifications to merchants to refund transactions before a chargeback procedure is initiated. With this new solution, the company also strengthens its chargeback management capabilities on the market to better serve all the players facing the challenges of chargeback and friendly fraud.

About Nethone

Nethone offers a risk detection product designed to protect the entire user journey, from onboarding to post-payment, at the same time helping merchants to holistically understand their end-users (good and bad). With the award-winning Know Your User (KYU) profiling technology and AI-powered tools, Nethone blocks all risky users without friction to the good ones by exhaustively screening every single one. Since 2022, Nethone has been part of Mangopay Group, a pan-European provider of platform payment & wallet infrastructure. In 2023, it was recognized as one of Europe’s fastest-growing companies by The Financial Times newspaper and data provider Statista.

nethone.com

About Verifi

Since 2005, Verifi has been a leader in the payments industry, providing innovative, end-to-end payment solutions that protect against fraud, prevent, and resolve disputes, and recover revenue lost to chargebacks. In 2019, Verifi was acquired by Visa, combining technologies to provide enhanced fraud and dispute management solutions on a global scale. Verifi creates strategic, adaptive technologies for sellers, payment facilitators, acquirers, and issuers, building sustaining partnerships to deliver value, increase profits, and promote brand growth.

verifi.com

For more information, please contact:

Magdalena Kowalska, Head of Marketing

magdalena.kowalska@nethone.com | +48 729 851 004